Kicking off with renter’s insurance options, this article dives into the different coverage options, costs, and factors to consider when choosing a policy. From basic coverage to comparison of insurance providers, get ready to explore it all.

Overview of Renter’s Insurance Options

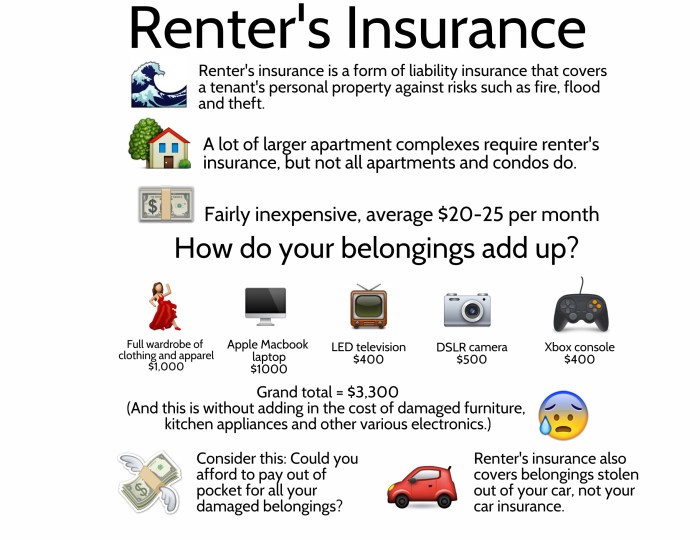

Renter’s insurance is a crucial protection for tenants, providing coverage for personal belongings and liability in case of unforeseen events. It offers peace of mind knowing that your possessions are safeguarded.

Types of Coverage Options

- Personal Property Coverage: This includes protection for your belongings such as clothing, electronics, and furniture from events like theft, fire, or vandalism.

- Liability Coverage: In case someone is injured in your rented property, this coverage helps with legal expenses and medical bills.

- Additional Living Expenses: If your rental becomes uninhabitable due to a covered event, this coverage helps with temporary living arrangements.

Benefits of Renter’s Insurance

- Financial Protection: Renter’s insurance provides financial support to replace or repair your belongings in case of damage or loss.

- Liability Coverage: It protects you from potential lawsuits or claims if someone is injured while visiting your rental property.

- Peace of Mind: Knowing that you have insurance coverage in place can give you peace of mind and security in case of unexpected situations.

Basic Coverage vs. Additional Coverage

When it comes to renter’s insurance, understanding the difference between basic coverage and additional coverage options can help renters make informed decisions to protect their belongings and liability.

Basic coverage typically includes protection for personal property, liability coverage, and additional living expenses in case of a covered loss. However, it’s essential to assess individual needs to determine if additional coverage is necessary to fill potential gaps in protection.

Common Additional Coverage Options

- Renter’s Insurance Riders: These are additional policy provisions that offer coverage for specific items not fully protected under the basic policy, such as high-value jewelry or electronics.

- Flood Insurance: While basic renter’s insurance typically doesn’t cover flood damage, renters can opt for additional flood insurance to protect their belongings in case of a flood event.

- Identity Theft Coverage: This type of coverage can help renters recover from identity theft-related expenses, such as legal fees or lost wages due to identity fraud.

- Earthquake Insurance: For renters living in earthquake-prone areas, adding earthquake insurance to their policy can provide coverage for damages caused by seismic activity.

Assessing Individual Needs

It’s crucial for renters to evaluate their lifestyle, location, and the value of their belongings to determine the level of coverage needed. Renters with valuable items or living in disaster-prone areas may benefit from additional coverage options to ensure comprehensive protection. Taking the time to assess individual needs can help renters customize their insurance policy to meet their specific requirements.

Cost Factors and Affordability

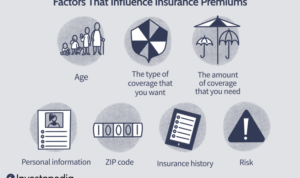

When it comes to renter’s insurance, the cost can vary depending on several key factors that influence the premiums. Understanding these factors and knowing how to find affordable options without compromising coverage is crucial for renters. Here, we’ll discuss some tips and strategies to help you save money on renter’s insurance.

Key Factors Influencing Cost

- The location of your rental property plays a significant role in determining the cost of renter’s insurance. Areas prone to natural disasters or with high crime rates may have higher premiums.

- The coverage amount and type you choose will directly impact the cost. Opting for a higher coverage amount or additional coverage options will increase the premiums.

- Your deductible amount can also affect the cost of renter’s insurance. Choosing a higher deductible can lower your premiums, but you’ll have to pay more out of pocket in case of a claim.

- Your credit score can influence the cost of insurance. Renters with a higher credit score may be eligible for lower premiums.

Tips for Finding Affordable Insurance

- Shop around and compare quotes from multiple insurance providers to find the best rates.

- Consider bundling your renter’s insurance with other policies, such as auto insurance, to receive a discount.

- Ask about discounts for safety features in your rental property, such as smoke alarms, security systems, or deadbolt locks.

- Review your coverage annually and make adjustments to ensure you’re not overpaying for coverage you don’t need.

Strategies for Saving Money

- Consider opting for a higher deductible to lower your premiums, but make sure you have enough savings to cover the deductible in case of a claim.

- Ask about discounts for being a long-term renter or for not filing any recent claims.

- Take advantage of any loyalty discounts offered by your insurance provider for renewing your policy with them.

- Consider paying your premium upfront for the year instead of monthly to potentially save on administrative fees.

Comparison of Insurance Providers: Renter’s Insurance Options

When looking for the right renter’s insurance policy, it’s essential to consider the different insurance providers available in the market. Each insurance company offers various coverage options, pricing plans, and customer service experiences. Therefore, comparing insurance providers is crucial to find the best fit for your needs.

Popular Insurance Companies Offering Renter’s Insurance

- State Farm: Known for its reliable coverage options and excellent customer service.

- Allstate: Offers customizable policies and competitive pricing.

- Geico: Provides affordable renter’s insurance plans with easy online access.

- Lemonade: Utilizes technology for a seamless application process and quick claims handling.

Comparison of Coverage Options, Pricing, and Customer Reviews, Renter’s insurance options

- State Farm: Offers comprehensive coverage with slightly higher pricing but receives positive customer reviews for claim handling.

- Allstate: Provides customizable policies to fit individual needs with moderate pricing and good customer feedback.

- Geico: Known for affordable rates but may have limitations in coverage options; receives mixed reviews for customer service.

- Lemonade: Utilizes AI for a fast and easy application process, competitive pricing, and positive customer reviews for responsiveness.

Selecting a Reputable Insurance Company

When choosing an insurance provider for your renter’s insurance needs, consider factors such as coverage options, pricing, customer reviews, and financial stability. Look for companies with a good reputation, strong customer service, and transparent policies. Additionally, compare quotes from different providers to ensure you get the best value for your money.