Looking into car financing options sets the stage for a thrilling ride through the world of loans, leases, and dealership deals. Get ready for a deep dive into the ins and outs of getting your dream car on the road.

From understanding interest rates to navigating hidden fees, we’ve got you covered with all you need to know to make the best financing decisions.

Car Financing Options Overview

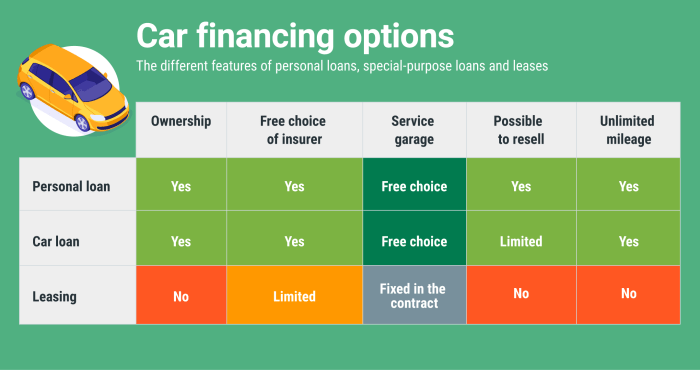

When it comes to getting behind the wheel of your dream car, there are several financing options to consider. Whether you choose to go with a traditional loan, a lease, or opt for dealership financing, each option comes with its own set of benefits and drawbacks.

Types of Car Financing Options

- Loans: Taking out a loan to finance your car purchase allows you to own the vehicle outright once the loan is paid off. However, it’s important to consider interest rates, loan terms, and monthly payments to ensure affordability.

- Leases: Leasing a car typically involves lower monthly payments compared to a loan, but you won’t own the vehicle at the end of the lease term. Leases often come with mileage restrictions and fees for excess wear and tear.

- Dealership Financing: Dealerships offer financing options through partnerships with banks or financial institutions. While convenient, dealership financing may come with higher interest rates compared to securing a loan independently.

It’s crucial to carefully review and understand interest rates, loan terms, and any hidden fees associated with each financing option to make an informed decision.

Understanding Auto Loans

When it comes to getting an auto loan, there are a few key factors to consider. Lenders will look at your credit score, income, and employment history to determine if you qualify for a loan and at what interest rate.

Applying for an Auto Loan

- Gather all necessary documents such as proof of income, identification, and insurance information.

- Shop around for the best interest rates and loan terms from different lenders.

- Submit your application along with the required documents and wait for approval.

Secured vs. Unsecured Auto Loans

Secured auto loans require collateral, such as the vehicle itself, which can be repossessed if you fail to make payments. Unsecured loans do not require collateral but typically have higher interest rates.

Credit Scores and Auto Loans

Your credit score plays a significant role in determining your auto loan approval and interest rate. A higher credit score generally leads to better loan terms, while a lower credit score may result in higher interest rates or even loan denial.

Leasing vs. Buying a Car

When it comes to deciding whether to lease or buy a car, there are several factors to consider. Let’s break down the differences between the two options to help you make an informed decision.

Leasing a car often involves lower upfront costs compared to buying. With leasing, you typically only need to pay a small down payment, if any, along with the first month’s payment and other fees. On the other hand, buying a car requires a larger upfront payment, including a down payment and taxes, as well as the full price of the vehicle.

In terms of monthly payments, leasing a car can also be more affordable than buying. Monthly lease payments are usually lower than loan payments for buying a car, making it a more budget-friendly option for some people. However, it’s important to note that at the end of a lease term, you do not own the car, whereas when you buy a car, you will eventually own it outright after completing the loan payments.

Depreciation and Its Impact

Depreciation is the decrease in value that occurs over time with a car. When you lease a car, you are only paying for the depreciation that occurs during the lease term, which can result in lower monthly payments. However, you do not build equity in the vehicle since you do not own it. When you buy a car, you are responsible for the full value of the vehicle, including its depreciation, but you have the opportunity to build equity over time as you pay off the loan.

Flexibility and Restrictions

Leasing a car offers the flexibility to upgrade to a new vehicle every few years without the hassle of selling or trading in a car. However, there are restrictions on mileage and wear and tear that can result in additional fees at the end of the lease. Buying a car gives you the freedom to customize and drive the vehicle as much as you want without worrying about excess charges, but you are responsible for selling or trading in the car when you’re ready for a new one.

Dealership Financing Options

When it comes to buying a car, dealership financing options can offer various incentives and deals to help you finance your purchase. These options are typically provided by the car manufacturer or the dealership itself, and they can include manufacturer incentives, rebates, and special financing deals.

Manufacturer Incentives and Rebates

Manufacturer incentives and rebates are discounts offered by the car manufacturer to incentivize customers to buy their vehicles. These incentives can come in the form of cash rebates, 0% APR financing, or special leasing deals. While these incentives can help you save money upfront, it’s essential to read the fine print and understand any eligibility requirements.

Special Financing Deals

Dealerships often provide special financing deals, such as low APR rates or extended loan terms, to attract customers. These deals can make financing more affordable and convenient, but it’s crucial to compare them to traditional bank loans to ensure you’re getting the best deal. Keep in mind that dealership financing may come with higher interest rates or hidden fees, so make sure to read the terms carefully.

Negotiating Financing Terms

Negotiating the financing terms at a dealership can have a significant impact on the overall cost of the car. By haggling over the interest rate, loan term, or down payment amount, you may be able to secure a better deal and save money in the long run. However, it’s essential to be prepared, do your research, and be willing to walk away if the terms aren’t favorable.