Home insurance guide sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Whether you’re a first-time homeowner or looking to switch insurance providers, understanding the ins and outs of home insurance is crucial. From coverage options to factors affecting rates, this guide has got you covered.

Introduction to Home Insurance

Home insurance is a crucial financial safety net for homeowners, providing protection against unforeseen events that could damage or destroy their property. It offers peace of mind knowing that in case of a disaster, the insurance policy will help cover the costs of repairs or replacement.

Types of Coverage in Home Insurance

- Property Coverage: This includes coverage for the physical structure of the home, as well as other structures on the property such as a garage or shed.

- Liability Coverage: Protects homeowners in case someone is injured on their property and decides to sue.

- Personal Property Coverage: Covers the belongings inside the home, like furniture, electronics, and clothing, in case of theft or damage.

- Additional Living Expenses: Provides coverage for temporary housing and living expenses if the home becomes uninhabitable due to a covered event.

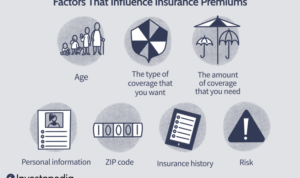

Factors Affecting Home Insurance Rates

- Location: Homes in areas prone to natural disasters like hurricanes or wildfires may have higher insurance rates.

- Age of Home: Older homes may cost more to insure due to potential risks associated with aging systems and materials.

- Coverage Limits: The amount of coverage you choose will directly impact your insurance rates. Higher coverage limits mean higher premiums.

Types of Home Insurance Coverage: Home Insurance Guide

When it comes to home insurance, there are different types of coverage options to consider. Understanding what each type covers can help you make informed decisions to protect your home and belongings.

Dwelling Coverage

Dwelling coverage is the most basic type of home insurance and protects the structure of your home, including walls, roof, floors, and other permanent fixtures. For example, if a tree falls on your roof during a storm, dwelling coverage would help pay for repairs to the roof.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, electronics, and clothing. If your belongings are stolen or damaged due to a covered event like a fire, personal property coverage can help replace them.

Liability Protection

Liability protection covers you in case someone is injured on your property and you are found legally responsible. For example, if a guest slips and falls in your home, liability protection can help cover their medical expenses and legal fees if they decide to sue.

Additional Living Expenses Coverage

Additional living expenses coverage helps pay for temporary housing and other living expenses if your home becomes uninhabitable due to a covered event, like a fire. This coverage can help you maintain your standard of living while your home is being repaired.

Remember, it’s essential to understand your policy limits and deductibles for each type of coverage. Policy limits refer to the maximum amount your insurance company will pay for a covered claim, while deductibles are the amount you must pay out of pocket before your insurance kicks in. Knowing these details can help you choose the right coverage for your needs.

Factors to Consider When Choosing Home Insurance

When selecting a home insurance policy, there are several key factors to keep in mind to ensure you have the right coverage for your needs.

Assessing the Value of Your Home and Belongings

Before choosing a home insurance policy, it’s crucial to accurately assess the value of your home and belongings. This will help you determine the appropriate coverage limits to protect your assets in case of any unforeseen events.

Comparing Quotes from Different Insurance Providers

It’s essential to shop around and compare quotes from various insurance providers to find the best coverage at a competitive price. Different insurers may offer different rates and coverage options, so doing your research can help you make an informed decision.

Customizing Your Home Insurance Policy

To tailor your home insurance policy to your specific needs, consider adding endorsements for valuable items or specific risks that may not be covered by a standard policy. By customizing your policy, you can ensure that you have the right level of protection for your unique situation.

Home Insurance Claims Process

When it comes to filing a home insurance claim, it’s essential to understand the steps involved to ensure a smooth process. From documenting the damage to working with an adjuster, each step plays a crucial role in getting the compensation you deserve.

Steps in Filing a Home Insurance Claim, Home insurance guide

- Document the Damage: Take photos or videos of the damage to your property and belongings.

- Contact Your Insurance Company: Notify your insurance provider as soon as possible to start the claims process.

- Meet with an Adjuster: An adjuster will assess the damage and determine the coverage and payout for your claim.

- Receive Compensation: Once your claim is approved, you will receive the compensation for your losses.

Common Reasons for Home Insurance Claim Denial

- Underinsurance: Having inadequate coverage for the damages claimed can lead to denial.

- Failure to Maintain Property: Neglecting regular maintenance of your property can result in claim rejection.

- Exclusions in Policy: Some damages may not be covered as per your policy terms, leading to denial.

Tips for Maximizing Payout from Home Insurance Claim

- Provide Detailed Documentation: Keep records of all communications, receipts, and documentation related to your claim.

- Get Multiple Estimates: Obtain multiple repair estimates to ensure fair compensation for the damages.

- Review Your Policy: Understand your coverage limits and exclusions to maximize the payout from your claim.