Car insurance deals are the key to unlocking savings on your auto coverage. From understanding different types of deals to finding the best offers, this guide has you covered.

As you dive into the world of car insurance deals, get ready to discover how to make the most out of your coverage while saving big.

Overview of Car Insurance Deals

Car insurance deals are special offers or packages provided by insurance companies to attract customers and provide them with affordable coverage for their vehicles. These deals are important because they allow drivers to protect their cars against unexpected incidents while saving money on insurance premiums.

Types of Car Insurance Deals

- Multi-Policy Discount: This deal offers a discount when you bundle your car insurance with other types of insurance, such as home or life insurance.

- Safe Driver Discount: Drivers with a clean record and no accidents may qualify for a safe driver discount, reducing their premiums.

- Paperless Billing Discount: Opting for paperless billing can lead to lower insurance rates, saving both money and the environment.

Benefits of Comparing Car Insurance Deals

- Save Money: By comparing different car insurance deals, you can find the most affordable option that meets your coverage needs.

- Customized Coverage: Comparing deals allows you to tailor your insurance policy to fit your specific requirements, ensuring you have the right amount of coverage.

- Customer Reviews: Researching and comparing deals gives you insight into the reputation and customer service of different insurance companies, helping you make an informed decision.

Factors to Consider When Choosing Car Insurance Deals

When selecting a car insurance deal, there are several important factors to take into consideration to ensure you are getting the coverage that best fits your needs and budget.

Coverage Options

- Consider the types of coverage offered, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Choose the coverage options that provide adequate protection based on your vehicle and driving habits.

- Ensure the policy includes any additional coverage you may need, such as rental car reimbursement or roadside assistance.

Deductibles

- Understand how deductibles work and choose a deductible amount that you can afford to pay out of pocket in the event of a claim.

- Higher deductibles typically result in lower premiums, but make sure you can cover the deductible if needed.

Premiums

- Compare premium rates from different insurance companies to find the best value for the coverage you need.

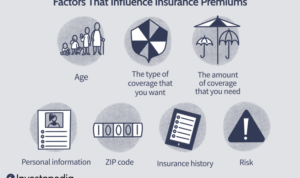

- Consider factors that can affect your premiums, such as your driving record, age, and credit score.

- Look for discounts that may be available, such as multi-policy, safe driver, or good student discounts.

Vehicle, Driving History, and Location

- The type of vehicle you drive can impact your insurance rates, with factors like make, model, and age affecting premiums.

- Your driving history, including accidents and traffic violations, can also influence the cost of your insurance.

- Where you live plays a role in insurance rates, as urban areas may have higher rates due to increased risk of accidents or theft.

It’s essential to read the fine print and understand the terms and conditions of any car insurance deal to avoid surprises or gaps in coverage when you need it most.

How to Find the Best Car Insurance Deals

Finding the best car insurance deals can be a daunting task, but with the right approach, you can save money and get the coverage you need. Here are some tips on how to find the best car insurance deals:

Use Comparison Websites, Car insurance deals

Comparison websites are a great tool for finding the best car insurance deals. These websites allow you to compare quotes from multiple insurers in one place, making it easy to find the best rates.

Consider Direct Insurers

Direct insurers, such as Geico or Progressive, can often offer competitive rates since they cut out the middleman. By going directly to the insurer, you may be able to find better car insurance deals.

Consult with Agents

Insurance agents can also help you find the best car insurance deals. They have access to a variety of insurers and can help you navigate the complex world of insurance to find the right coverage at the best price.

Review Customer Reviews and Ratings

When evaluating car insurance deals, it’s important to consider customer reviews and ratings. This can give you insight into the quality of service provided by the insurer and help you make an informed decision.

Negotiate for Better Deals

Don’t be afraid to negotiate with insurers for better car insurance deals. You can ask for discounts, bundle policies, or increase deductibles to lower your premium. Insurers are often willing to work with you to find a deal that fits your budget.

Common Mistakes to Avoid When Choosing Car Insurance Deals

When it comes to selecting car insurance deals, there are several common mistakes that you should steer clear of to ensure you get the best coverage for your needs.

Underinsuring: One of the biggest mistakes people make is underinsuring their vehicles. Opting for the minimum coverage required by law might seem like a cost-effective choice, but it can leave you vulnerable in case of accidents or emergencies that exceed the coverage limits.

Not shopping around: Another mistake to avoid is not taking the time to shop around and compare different car insurance deals. By exploring multiple options, you can find the best coverage at the most competitive rates that suit your budget and needs.

Choosing the cheapest deal without considering coverage adequacy: While it’s tempting to go for the cheapest car insurance deal available, it’s essential to ensure that the coverage provided is adequate for your vehicle and circumstances. Opting for the lowest price without considering coverage levels can lead to significant financial risks in the event of an accident or damage.

Letting car insurance deals auto-renew without reassessing options: Lastly, a common mistake is letting car insurance deals auto-renew without reassessing your coverage needs or comparing new offers in the market. By reassessing your options annually, you can ensure that you’re getting the best deal and coverage for your current situation.

Implications of Common Mistakes

- Underinsuring can result in financial strain if you have to pay out of pocket for damages that exceed your coverage limits.

- Not shopping around may cause you to miss out on better deals and discounts offered by other insurance providers.

- Choosing the cheapest deal without adequate coverage can leave you exposed to high costs in case of accidents or theft.

- Letting car insurance auto-renew without reassessing can lead to missed opportunities for savings and improved coverage options.