Get ready to dive into the world of crypto staking rewards, where earning potential meets the digital age in a thrilling fusion of technology and finance. From understanding the basics to exploring the benefits, this journey will equip you with the knowledge to make the most of your investments.

What is Crypto Staking Rewards?

Crypto staking rewards refer to the process where cryptocurrency holders participate in the validation of transactions on a blockchain network by locking up a certain amount of their coins. In return for this, they receive rewards in the form of additional coins.

How Crypto Staking Rewards Work

Staking rewards work by incentivizing cryptocurrency holders to actively participate in securing the network and maintaining its operations. This is typically done by holding a certain amount of coins in a designated wallet to support the blockchain’s functionality. By staking their coins, users help validate transactions and create new blocks, which in turn earns them rewards.

- Users lock up their coins in a staking wallet to participate in the network.

- Validators confirm transactions and add new blocks to the blockchain.

- Validators are rewarded with additional coins for their participation in the network.

Popular Cryptocurrencies Offering Staking Rewards

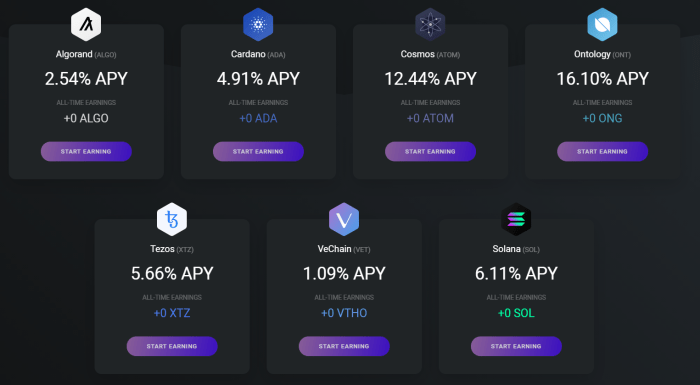

Some of the popular cryptocurrencies that offer staking rewards include:

- Ethereum (ETH): Ethereum is transitioning from a proof-of-work to a proof-of-stake consensus mechanism with Ethereum 2.0, allowing users to stake their ETH to earn rewards.

- Cardano (ADA): Cardano allows users to stake their ADA coins to help secure the network and in return, earn staking rewards.

- Tezos (XTZ): Tezos utilizes a proof-of-stake consensus mechanism where users can delegate their XTZ coins to validators and earn rewards for their participation.

Benefits of Crypto Staking Rewards

Cryptocurrency staking rewards offer several advantages to investors looking to grow their digital assets. One of the key benefits is the opportunity to earn passive income simply by holding and staking their coins in a secure wallet. This process involves participating in the consensus mechanism of a blockchain network, helping to validate transactions and maintain the network’s security.

Generating Passive Income

Staking rewards allow investors to earn a regular income in the form of additional tokens or coins without actively trading or making investment decisions. By staking their crypto assets, investors contribute to the network’s operations and are rewarded for their participation. This passive income stream can provide a steady source of revenue over time, especially in a volatile market.

- Investors can earn staking rewards by holding their coins in a staking wallet and participating in network activities.

- Staking rewards are typically paid out regularly, providing investors with a predictable income stream.

- Staking rewards can compound over time, allowing investors to grow their holdings without additional investment.

Comparison with Other Income Streams

When compared to other forms of generating income in the crypto market, such as trading or mining, staking rewards offer a more passive and stable way to earn returns on investment. Unlike trading, which requires active monitoring and decision-making, staking allows investors to earn rewards without constantly buying and selling assets. Additionally, staking does not involve the high energy costs associated with mining, making it a more eco-friendly option for earning income in the crypto space.

- Staking rewards are less affected by market volatility compared to trading activities.

- Staking requires minimal technical knowledge and can be easily done by holding coins in a staking wallet.

- Staking rewards are more sustainable and environmentally friendly than mining activities.

How to Stake Cryptocurrencies for Rewards

Staking cryptocurrencies can be a lucrative way to earn passive income in the crypto space. By participating in the staking process, users can contribute to the security and operation of blockchain networks while being rewarded with additional tokens. Here, we will explore the steps involved in staking cryptocurrencies to earn rewards.

Proof of Stake (PoS) and Delegated Proof of Stake (DPoS), Crypto staking rewards

- Proof of Stake (PoS): In a PoS system, validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. Validators are rewarded with additional tokens for their participation in securing the network.

- Delegated Proof of Stake (DPoS): DPoS is a variation of PoS where token holders vote for delegates who will validate transactions on their behalf. Delegates are responsible for securing the network and are rewarded with tokens for their services.

Tips for Choosing the Right Staking Platform

- Research the Project: Before staking your coins, make sure to research the project thoroughly. Look into the team behind the project, the technology they are using, and the roadmap for future development.

- Security and Transparency: Choose a staking platform that offers robust security measures to protect your assets. Look for platforms that are transparent about their operations and have a track record of reliability.

- Rewards and Fees: Consider the rewards offered by the staking platform and the fees associated with staking. Compare different platforms to find the one that offers the best balance of rewards and fees.

- User Experience: A user-friendly interface and seamless staking process can make a significant difference in your staking experience. Choose a platform that is easy to use and navigate.

Risks and Considerations

When it comes to staking cryptocurrencies for rewards, there are certain risks and considerations that you should keep in mind to protect your investments and ensure a smooth staking experience.

Potential Risks Associated with Crypto Staking Rewards

- Volatility: The value of cryptocurrencies can fluctuate rapidly, affecting the rewards you earn from staking.

- Slashing: Some staking protocols may penalize you for malicious behavior or downtime, resulting in a loss of staked assets.

- Security Risks: Staking involves exposing your assets to potential security threats such as hacking or fraud.

Factors to Consider Before Staking Cryptocurrencies for Rewards

- Research: Thoroughly investigate the staking project, its team, technology, and community before committing your assets.

- Reward Structure: Understand the staking rewards, fees, and lock-up periods associated with the project to manage your expectations.

- Risk Tolerance: Assess your risk tolerance and only stake an amount that you can afford to lose in case of unforeseen events.

Security Measures to Protect Staked Assets in the Crypto Ecosystem

- Hardware Wallets: Consider using hardware wallets to store your staked assets offline and protect them from online threats.

- Multi-Signature Wallets: Utilize multi-signature wallets that require multiple private keys to authorize transactions, adding an extra layer of security.

- Regular Audits: Monitor your staking activities regularly, audit smart contracts, and stay updated on security best practices to prevent potential risks.