Insurance premium calculation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Understanding how insurance premiums are calculated is crucial for navigating the complex world of insurance. From the factors that influence premium calculation to the latest technology trends, this topic is a blend of finance, data analysis, and innovation.

Understanding Insurance Premium Calculation

Insurance premium calculation is the process insurers use to determine the amount a policyholder must pay for their insurance coverage. This calculation takes into account various factors to assess the level of risk associated with insuring a particular individual or entity.

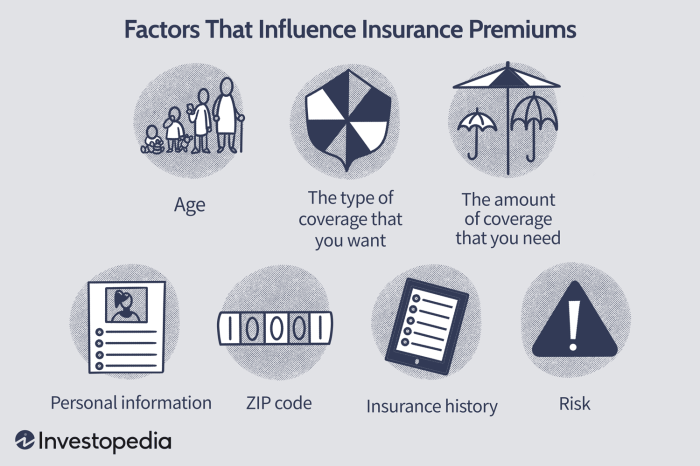

Factors Influencing Insurance Premium Calculation

- The type of insurance coverage being purchased

- The policyholder’s age, gender, and location

- The policyholder’s health status (for health insurance)

- The policyholder’s driving record (for auto insurance)

- The value of the insured property (for property insurance)

Importance of Accurate Premium Calculation in the Insurance Industry

Accurate premium calculation is crucial in the insurance industry as it ensures that insurers can cover potential claims while also remaining financially stable. If premiums are set too low, insurers may not have enough funds to pay out claims, leading to financial distress. On the other hand, if premiums are set too high, policyholders may be discouraged from purchasing insurance, resulting in a lack of coverage when needed.

Factors Affecting Insurance Premium Calculation

Insurance companies take into account several key factors when calculating premiums to determine the amount of risk associated with insuring a particular individual. These factors help insurers set an appropriate price for coverage based on the likelihood of a claim being filed.

Demographic Information Impact

Demographic information such as age, gender, and location plays a significant role in premium calculation. Younger individuals are often charged higher premiums as they are considered riskier to insure due to their lack of driving experience or health risks. Gender can also impact premiums, with statistics showing that males may have higher accident rates, leading to higher premiums. Additionally, location matters as well, with urban areas typically having higher premiums due to increased exposure to risks like theft or accidents.

Risk Assessment in Premium Calculation

Risk assessment is a crucial aspect of determining insurance premiums. Insurers evaluate various factors such as the individual’s health history, driving record, occupation, and lifestyle habits to assess the level of risk they pose. For example, a person with a history of speeding tickets or a dangerous occupation may be charged higher premiums due to the increased likelihood of filing a claim. By conducting risk assessments, insurance companies can tailor premiums to reflect the specific risk profile of each policyholder.

Techniques and Methods for Calculating Insurance Premiums: Insurance Premium Calculation

Insurance companies use various methods to calculate premiums, taking into account factors like risk, exposure, and underwriting. Each method plays a crucial role in determining the final premium amount.

Actuarial Method

The actuarial method involves using statistical data and mathematical models to analyze risk and predict future claims. Actuaries assess various factors like age, health history, and previous claims to determine the likelihood of a policyholder filing a claim. Based on this analysis, they calculate the premium amount that adequately covers the expected claims and expenses.

Exposure Method

The exposure method focuses on the level of risk that an insured party is exposed to. Insurance companies consider the potential losses associated with the insured property or individual. For example, a homeowner located in a high-risk flood zone will likely have a higher premium compared to a homeowner in a low-risk area. The exposure method directly links the premium amount to the level of risk faced by the insured party.

Underwriting Method, Insurance premium calculation

The underwriting method involves a detailed evaluation of an applicant’s risk profile. Underwriters assess factors such as occupation, credit history, and lifestyle choices to determine the likelihood of a claim being filed. Based on this assessment, underwriters set the premium amount that reflects the individual’s risk level. For example, a person with a history of speeding tickets may face a higher premium for auto insurance.

These methods work in conjunction to calculate insurance premiums accurately. By utilizing a combination of actuarial, exposure, and underwriting techniques, insurance companies can determine a fair and competitive premium amount for their policyholders.

Technology and Automation in Premium Calculation

Technology plays a crucial role in automating the insurance premium calculation process, revolutionizing the way insurers determine the cost of coverage for policyholders. By leveraging advanced technologies like Artificial Intelligence (AI) and machine learning, insurance companies can improve the accuracy and efficiency of premium calculations.

Role of AI and Machine Learning

AI and machine learning algorithms are being utilized to analyze vast amounts of data quickly and accurately, enabling insurers to make more informed decisions when calculating premiums. These technologies can identify patterns, trends, and risk factors that may not be apparent through traditional methods, leading to more precise pricing for policies.

- AI algorithms can analyze customer data to assess risk profiles and predict potential claims, helping insurers set premiums based on individual risk factors.

- Machine learning models can continuously learn and adapt to new data, refining the premium calculation process over time for increased accuracy.

- Automation through AI and machine learning reduces manual errors and speeds up the premium calculation process, allowing insurers to provide quotes faster to customers.

AI and machine learning algorithms can process and analyze data at a speed and scale that surpasses human capabilities, enabling insurers to optimize premium calculations for better risk management.

Benefits and Challenges

Utilizing technology for premium calculation offers numerous benefits, such as improved accuracy, increased efficiency, and enhanced customer experience. However, there are also challenges associated with integrating AI and machine learning into insurance processes.

- Benefits:

- Enhanced accuracy in risk assessment leads to more precise premium pricing.

- Efficiency gains through automation reduce manual workload and processing time.

- Improved customer experience with faster quotes and tailored coverage options.

- Challenges:

- Ensuring data privacy and security when handling sensitive customer information.

- Managing and interpreting complex algorithms to avoid biases or errors in premium calculations.

- Investing in technology infrastructure and training to support AI and machine learning implementations.