Long-term care insurance, a crucial aspect of financial planning, ensures you’re prepared for unforeseen healthcare needs as you age. Dive into the world of long-term care insurance with us for a hip and informative ride!

Overview of Long-Term Care Insurance

Long-term care insurance is a type of coverage that helps individuals pay for services and support they may need as they age or if they have a chronic illness or disability. The purpose of long-term care insurance is to provide financial protection for the high costs associated with long-term care, such as assistance with daily activities like bathing, dressing, and eating.

Types of Care and Services Covered

- Assisted living facilities: Long-term care insurance can cover the cost of living in an assisted living facility, where individuals receive help with daily tasks but still have some level of independence.

- Nursing home care: This type of care is covered by long-term care insurance for individuals who require 24-hour skilled nursing care and assistance with daily activities.

- In-home care: Long-term care insurance can also cover the cost of in-home care services, such as nursing care, physical therapy, and help with household chores.

Importance of Having Long-Term Care Insurance

Having long-term care insurance is essential because it helps protect your savings and assets from being depleted by expensive long-term care costs. Without insurance, these costs can quickly add up and put a significant financial burden on you and your family. Long-term care insurance provides peace of mind knowing that you have coverage in place to help you access the care and services you may need in the future.

Benefits of Long-Term Care Insurance

Long-term care insurance offers numerous advantages for individuals and families. It provides financial protection in the event of needing long-term care services, such as nursing home care, assisted living, or in-home care. Without this insurance, these services can be extremely costly and could potentially deplete one’s savings.

Peace of Mind and Financial Security

- Long-term care insurance provides peace of mind knowing that you are financially prepared for any unexpected long-term care needs.

- It helps protect your assets and savings from being wiped out by expensive long-term care services.

Flexibility and Control

- With long-term care insurance, you have the flexibility to choose where and how you receive care, whether it’s in a nursing home, assisted living facility, or at home.

- It gives you control over your long-term care decisions and allows you to maintain independence and dignity.

Relief for Family and Loved Ones

- Having long-term care insurance can relieve the financial burden on your family and loved ones who may otherwise have to cover the costs of your care.

- It can help prevent family members from having to become caregivers, allowing them to maintain their own quality of life.

Comparison with Other Forms of Insurance, Long-term care insurance

- Unlike health insurance, long-term care insurance specifically covers the costs associated with long-term care services, which are not typically covered by health insurance.

- It complements Medicare, as Medicare only covers short-term care or rehabilitation services, while long-term care insurance covers more extended care needs.

Cost and Coverage

When it comes to long-term care insurance, understanding the cost and coverage is crucial for making the right decision to protect yourself in the future. Let’s break it down for you:

Cost of Long-Term Care Insurance

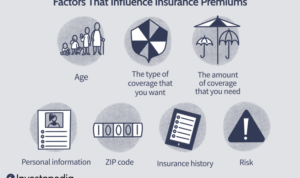

The cost of long-term care insurance is determined by several factors, including your age, health status, the amount of coverage you choose, and the length of the benefit period. Generally, the younger and healthier you are when you purchase the policy, the lower the premiums will be. It’s essential to shop around and compare quotes from different insurance companies to find the best rate that fits your budget.

Factors Influencing Coverage

The coverage provided by long-term care insurance is influenced by factors such as the type of care you want (in-home care, assisted living, nursing home care), the daily benefit amount, the maximum benefit period, and any optional benefits you choose to add to your policy. It’s important to carefully review and understand the policy details to ensure you have the coverage you need when the time comes.

Choosing the Right Coverage

To choose the right coverage based on your individual needs, consider factors such as your current health status, family history of long-term care needs, financial situation, and personal preferences for care. It’s recommended to work with a knowledgeable insurance agent or financial advisor who can help you navigate the options and tailor a policy that meets your specific requirements. Remember, the goal is to have peace of mind knowing that you have the coverage in place to protect your assets and ensure you receive the care you deserve in the future.

Eligibility and Exclusions

To qualify for long-term care insurance, individuals typically need to meet certain age and health criteria. Generally, those who are over the age of 50 and in relatively good health are eligible for coverage. However, eligibility requirements can vary depending on the insurance provider and policy.

Common Exclusions

- Pre-existing conditions: Many long-term care insurance policies exclude coverage for pre-existing conditions. This means that if you have a health issue that existed before purchasing the policy, expenses related to that specific condition may not be covered.

- Self-inflicted injuries: Coverage may not apply to injuries or illnesses that are self-inflicted, such as substance abuse or intentional harm.

- Mental health conditions: Some policies may have limitations or exclusions when it comes to coverage for mental health conditions or disorders.

- Experimental treatments: Long-term care insurance may not cover experimental or alternative treatments that are not considered standard medical care.

Impact of Pre-existing Conditions

Having pre-existing conditions can impact both eligibility and coverage under a long-term care insurance policy. In some cases, individuals with certain health conditions may be denied coverage altogether. For those who are approved, the pre-existing conditions may be excluded from coverage, requiring the individual to pay for related expenses out of pocket.