Long-term care insurance offers a vital safety net for individuals, providing financial security and peace of mind for the future. In a world where uncertainties abound, having the right coverage can make all the difference. Let’s dive into the world of long-term care insurance and explore why it’s a crucial investment for your wellbeing.

What is Long-Term Care Insurance?

Long-term care insurance is a type of coverage that helps individuals pay for services needed when they are unable to perform basic activities of daily living on their own due to illness, disability, or cognitive impairment. This insurance is crucial as it provides financial assistance for long-term care services that are not typically covered by health insurance, Medicare, or Medicaid.

Coverage Provided by Long-Term Care Insurance Policies

Long-term care insurance policies usually cover a range of services such as nursing home care, assisted living facilities, in-home care, adult day care, and rehabilitation services. These policies can also cover services like physical therapy, occupational therapy, and speech therapy that help individuals regain their independence.

Benefits of Long-Term Care Insurance

- Prevents exhausting personal savings: Long-term care insurance helps protect individuals’ assets and savings from being depleted by the high costs of long-term care services.

- Provides flexibility and choice: With long-term care insurance, individuals have the freedom to choose where and how they receive care, whether it’s in a nursing home, assisted living facility, or at home.

- Relieves burden on family members: Having long-term care insurance in place can ease the financial and emotional burden on family members who may otherwise have to provide care or pay for long-term care services out of pocket.

Types of Long-Term Care Insurance Policies

When it comes to long-term care insurance, there are different types of policies available in the market. These policies vary in terms of coverage, costs, and benefits, catering to different needs and preferences.

Traditional Long-Term Care Insurance

Traditional long-term care insurance policies are standalone policies specifically designed to cover long-term care expenses. These policies typically provide coverage for nursing home care, assisted living facilities, adult day care, and home health care services. Policyholders pay premiums regularly and can access benefits when they need long-term care.

Hybrid Long-Term Care Insurance

Hybrid long-term care insurance policies combine long-term care coverage with life insurance or annuities. These policies offer a death benefit if long-term care is never needed, providing a financial safety net for policyholders. Hybrid policies are flexible and can offer a variety of benefits, including inflation protection and return of premium options.

Traditional long-term care insurance requires regular premium payments, while hybrid policies offer a death benefit if long-term care is not needed.

Advantages and Disadvantages

- Traditional Long-Term Care Insurance:

- Advantages:

- Coverage specifically tailored for long-term care needs

- Potential for lower premiums compared to hybrid policies

- Long-term care benefits can be tax-deductible

- Disadvantages:

- Premiums can increase over time

- No death benefit if long-term care is not needed

- May require underwriting and medical exams

- Hybrid Long-Term Care Insurance:

- Advantages:

- Combines long-term care coverage with life insurance or annuities

- Offers a death benefit if long-term care is not needed

- Flexible benefit options and riders available

- Disadvantages:

- Premiums can be higher compared to traditional policies

- Less common in the market, limited availability

- May have stricter underwriting requirements

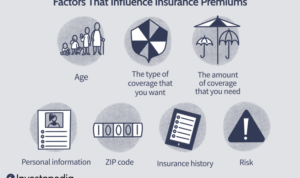

Factors to Consider When Choosing Long-Term Care Insurance

When selecting a long-term care insurance policy, there are several key factors individuals should consider to ensure they choose the most suitable coverage for their needs.

Age

Age plays a significant role in determining the cost and availability of long-term care insurance. Generally, the younger you are when you purchase a policy, the lower the premiums will be. It is advisable to secure coverage at a younger age to lock in lower rates and ensure you are covered in the future.

Health Status

Your current health status can impact both the cost and eligibility for long-term care insurance. Individuals with pre-existing medical conditions may face higher premiums or even be denied coverage. It is crucial to assess your health status before purchasing a policy and understand how it may affect your insurance options.

Financial Situation

Your financial situation also plays a vital role in choosing long-term care insurance. Evaluate your income, assets, and retirement savings to determine how much coverage you can afford and what level of benefits you may need in the future. It is important to strike a balance between adequate coverage and affordability to ensure you can comfortably pay for your policy.

Long-Term Care Insurance Coverage

Long-term care insurance typically covers a range of services that help individuals with activities of daily living or medical care needs that arise due to chronic illness, disability, or aging.

Typical Services Covered by Long-Term Care Insurance

- Nursing home care

- Assisted living facility care

- In-home care services

- Adult day care services

- Physical, occupational, and speech therapy

- Care coordination services

Limitations and Exclusions of Long-Term Care Insurance Policies

- Pre-existing conditions may be excluded from coverage

- Some policies have a waiting period before benefits kick in

- Certain high-risk activities or conditions may not be covered

- There may be limits on the duration or amount of coverage provided

Process of Filing a Claim and Utilizing Long-Term Care Insurance Benefits

- Notify the insurance company when care is needed

- Submit required documentation such as care plans and medical records

- Once the claim is approved, benefits can be used to pay for covered services

- Regularly review and update the care plan to ensure continued coverage